London new-build home sales suffer ‘catastrophic’ plunge

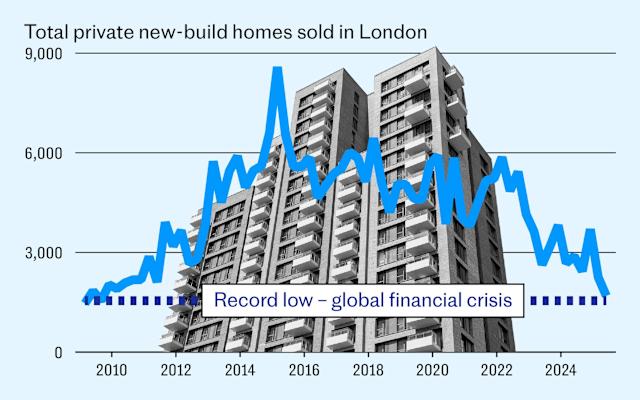

Sales of new-build homes in London have slumped to their lowest level since the global financial crisis.

Just 3,946 new private and build-to-rent properties were sold in the capital between January and June this year – a fall of nearly 30pc compared to the same period last year, according to research from Molior.

The slump has been more pronounced over the past three months, with only 1,691 homes sold in April, May and June. That is the lowest level since the global financial crisis, when 1,549 new build properties changed hands in the third quarter of 2009. Just over 3,300 were sold in the first half of that year.

The decline has been blamed on the insufficient financial incentives for property developers to build new homes and for buyers to purchase them, leading to fewer developments and sales.

Tim Craine, founder at Molior, said the fall was “catastrophic” and blamed London’s City Hall for deterring more new homes from being built.

“The market is now as bad as it was in early 2009, perhaps the early 1990s. But at least back then, the market was allowed to function,” he said.

Crucially, Mr Craine said the Greater London Authority, the body that governs London, was negotiating “too hard” in demanding higher taxes from housing developers to fund affordable housing – putting developers off building more homes.

He said that “if developers can’t sell homes, they won’t build them”. He added: “Remember, the Soviets used to set the price of bread. Guess what? No one made any bread. This is the same kind of thing.”

‘High risk of failure’

The plunge in sales has major implications for the Mayor of London’s target of building 88,000 homes per year – with the latest total representing only 9pc of 44,000 homes at the half-year mark, Mr Craine said.

Efforts made by the Government to resolve supply-side delays through reforms to the planning system and at the Building Safety Regulator will still leave “a significant demand-side problem”, he said.

Charlie Hart, from property consultancy Knight Frank, warned that over-regulation was “stifling delivery” from property developers.

He said: “Without urgent address by both central Government and London City Hall, the capital’s development, construction and other associated sectors – a cornerstone of its economy – are at high risk of failure.

“Immediate action is needed to relieve the pressure, and both buy-side and supply-side reform will help unlock delivery as well as demand.”

Mr Craine added that the situation was made worse by a lack of discounts to incentivise domestic buyers who purchase off-plan, several of whom have already been “pushed out” of the market by the Chancellor’s stamp duty increases, and persistently high building costs.

Story ContinuesHe said an increase in sales, driven by more demand-side initiatives, will give developers “the confidence to start building again at pace”.

The news comes after house prices across the UK stalled in June, according to Halifax, amid a slowdown in the jobs market and concerns about the economy.

In 2009, the UK’s property market was hit by a global slump in house prices, triggered by the US subprime mortgage crisis. Britain also endured a housing crash in the early 1990s, driven by rising unemployment and high interest rates.

The Mayor of London’s office was contacted for comment.

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 1 month with unlimited access to our award-winning website, exclusive app, money-saving offers and more.