Depending on the closeness of friends and family members, a financial gift can either come as a genuine support or it might come with invisible strings that prove to be more complicated than the money is worth. Only you can make that call.

Find Out: Suze Orman Says If You’re Doing This, You’re ‘Making the Biggest Mistake in Life’

Read Next: Mark Cuban Says Trump's Executive Order To Lower Medication Costs Has a 'Real Shot' -- Here's Why

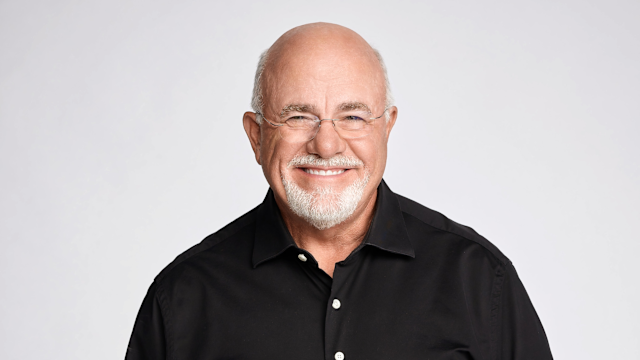

A young man called into finance expert Dave Ramsey’s show, “The Ramsey Show,” with a related problem: His grandmother had given him and his wife a gift of $9,000 to be used as they saw fit: for wedding planning, toward a home purchase or whatever they wanted, saying that she did not expect the money back.

Over time, however, Grandma started fishing for personal financial information, such as how they were doing financially, which made the caller nervous. Soon, Grandma now not only wanted her money back, she wanted it back with interest, to the tune of around $12,000.

With a household income, after taxes, of around $70,000, $12,000 is a lot of money for the caller and his wife to pay back.

Here’s what Dave Ramsey recommended they do (and what lessons can you take away from this story).

Keep the Peace or Do What’s Right?

Ramsey took the side of the caller, saying, “You do not morally owe her a dime.” He suggested that the caller could just as easily take Grandma to task by reminding her that she had patently called the money a gift and was now reneging on that agreement. He told the caller he would be within his rights not to pay her back.

However, Ramsey said he suspected the likely result of doing so was that Grandma would become “Mt. Vesuvius, because she likes to pull people’s strings, and when they don’t dance at the end of her string, she has a little fit.”

The caller agreed this was likely, given Grandma’s history of doing similar things to his parents.

Ramsey suggested that a person in this position has to make a choice between keeping the peace and doing what feels “right” to them, which might include maintaining peace in family or being able to literally go home for the holidays.

Learn More: 7 Signs You’re Quietly Getting Rich, According to Frugal Living Expert Austin Williams

A Practical Choice

Assuming correctly that the caller did not want to handle emotional upheaval or family drama, Ramsey suggested another alternative, a more practical, if disappointing, choice: to pay Grandma back, even though that wasn’t the original agreement.

Even within this scenario he urged the caller to think through his options that included making a payment plan and staying tethered to a manipulative relative for a long stretch of time, paying off only exactly the amount “gifted,” or paying off the total “plus interest” as Grandma now claimed they owed. The choice was the caller’s.

Story ContinuesIf the caller opted to pay Grandma back, Ramsey recommended getting the money paid off as quickly as possible — saving it in an account until it was all there — and making a clean break. However, he did warn that Grandma’s manipulations might not stop there. If they paid the extra interest she was now “charging,” he suggested she might suddenly find a way to keep asking for more. Sometimes, a hard boundary is necessary.

It was up to the caller to decide.

To recap, Ramsey’s suggestions for your choices in a situation where a gift has been given and then rescinded include:

-

Tell the person sorry, you’re keeping what was given freely and deal with the fallout.

-

Pay the person back either all at once or set up a payment plan, but only the amount given and not a penny more.

-

Pay back the full amount with interest to keep a complicated relationship from getting worse.

If any of these options don’t appeal, or don’t apply, you can also:

-

Look into mediation with a neutral third party to try to reach a peaceful resolution.

-

Speak with a financial therapist to work out complicated emotions before making a decision.

-

Seek legal advice if the person threatens court action.

-

Write a formal letter clarifying the original terms of the gift and your intended course of action.

-

Get documentation in writing to prevent future misunderstandings if you choose to repay.

-

Establish a firm boundary and step back from communication for a period of time.

-

Consult a consumer protection attorney if harassment or manipulation continues.

No matter what option you choose, get it in writing and have it witnessed and notarized. Additionally, it’s probably a good time to lean into very clear communication and get everything in writing when it comes to financial gifts.

More From GOBankingRates

-

3 Luxury SUVs That Will Have Massive Price Drops in Summer 2025

-

4 Things You Should Do if You Want To Retire Early

-

The 10 Most Reliable SUVs of 2025

-

The 5 Car Brands Named the Least Reliable of 2025

This article originally appeared on GOBankingRates.com: Dave Ramsey: What To Do If Someone Asks for Their Monetary Gift Back