Camden Property Trust CPT is slated to report second-quarter 2025 results on July 31, after market close. The company’s quarterly results are likely to display a year-over-year rise in revenues, though funds from operations (FFO) per share might display a decline.

In the last reported quarter, this residential real estate investment trust (REIT) reported FFO per share of $1.72, delivering a surprise of 2.38%. Results reflected higher same-property net operating income (NOI) and improved occupancy.

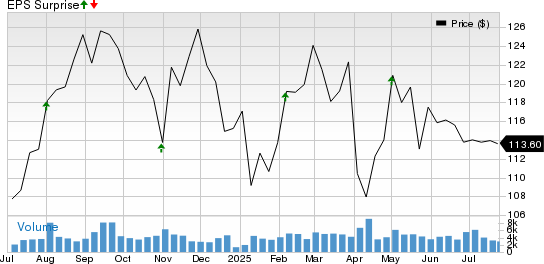

In the preceding four quarters, CPT’s FFO per share outpaced the Zacks Consensus Estimate on all occasions, with the average beat being 2.39%. The graph below depicts this surprise history:

Camden Property Trust Price and EPS Surprise

Camden Property Trust price-eps-surprise | Camden Property Trust Quote

In this article, we will dive deep into the U.S. apartment market environment and the company's fundamentals and analyze the factors that may have contributed to its second-quarter 2025 performance.

US Apartment Market in Q2

The U.S. apartment market remained impressively resilient in the second quarter of 2025, absorbing more than 227,000 units between April and June, a robust second-quarter figure. According to RealPage data, annual absorption surpassed even the peak leasing surge of 2021 and early 2022, defying a backdrop of slowing job growth, weak business sentiment and broader economic uncertainty.

While rent growth stayed muted, up just 0.19% in June, occupancy climbed steadily. At 95.6% in June, national occupancy rose 140 basis points year over year. Operators appear focused on maximizing occupancy, even if it means sacrificing rent increases. This “heads-in-beds” approach supports stability during a period of high new supply.

Supply, though moderating, remains historically elevated. More than 535,000 units were completed in the past year, with roughly 108,000 delivered in the second quarter alone. Yet, the market’s ability to digest this volume underscores its underlying strength.

Regionally, tech-driven markets like San Francisco and San Jose, as well as Boston and New York, gained momentum — likely aided by easing supply and increased return-to-office trends. Sun Belt markets, such as Dallas, Atlanta and Jacksonville, FL, also showed signs of recovery in the second quarter, sustaining robust demand amid declining deliveries. Tourism-dependent cities, like Las Vegas, Orlando, FL, and Nashville, TN, faltered slightly, possibly reflecting softening discretionary spending. Supply-heavy markets like Austin, Phoenix and Denver continued to see the sharpest rent cuts.

Factors at Play for Camden Property and Q2 Projections

In the second quarter of 2025, Camden is expected to have benefited from sustained renter demand across high-growth U.S. markets, supporting occupancy and blended lease rate gains. These markets enjoy strong job creation in high-income sectors and continue to see positive in-migration. Rising homeownership costs are limiting renter-to-owner transitions, making multifamily rentals more attractive.

Camden’s strategic presence across both urban and suburban areas is likely to have contributed to stable top-line performance. Additionally, the company’s focus on technology, operational scale and organizational strength is anticipated to have improved efficiency, lowered costs and supported NOI growth through margin expansion and enhanced resident satisfaction across its portfolio.

According to its May investor presentations, its second-quarter performance through May 29 exhibited seasonal improvement over the first quarter, as expected. Second-quarter occupancy also trended at 95.6% compared with 95.4% in the first quarter, while blended rate growth trended in line with the guidance of 0%-1%.

For the second quarter, the Zacks Consensus Estimate for CPT’s revenues currently stands at $393.82 million, implying growth of 1.7% from the year-ago reported number.

For the second quarter, Camden expected core FFO per share in the range of $1.67-$1.71. However, before the second-quarter earnings release, the company’s activities were not adequate to gain analysts’ confidence. The Zacks Consensus Estimate for the quarterly core FFO per share has remained unchanged in the past two months at $1.69, which lies within the guided range but suggests a decline of 1.17% year over year.

Here Is What Our Quantitative Model Predicts for CPT:

Our proven model does not conclusively predict a surprise in terms of FFO per share for Camden this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an FFO beat, which is not the case here.

Camden currently carries a Zacks Rank of 2 and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks That Warrant a Look

Here are two stocks from the residential REIT sector, American Homes 4 Rent AMH and Independence Realty Trust, Inc. IRT, you may want to consider as our model shows that these have the right combination of elements to report an FFO beat this quarter.

American Homes 4 Rent, scheduled to report quarterly numbers on July 31, has an Earnings ESP of +0.31% and carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Independence Realty Trust is slated to report quarterly numbers on July 30. IRT has an Earnings ESP of +0.79% and carries a Zacks Rank of 3 at present.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Camden Property Trust (CPT) : Free Stock Analysis Report

Independence Realty Trust, Inc. (IRT) : Free Stock Analysis Report

American Homes 4 Rent (AMH) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research