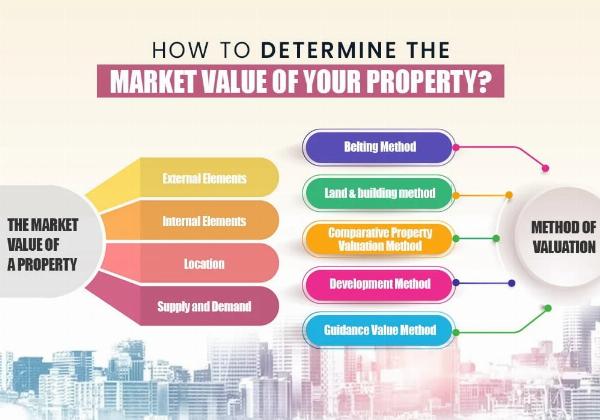

Understanding your home's market value is crucial whether you’re looking to sell, refinance, or simply assess your investment. Market value is essentially what a buyer is willing to pay for your property in the current market. Here’s a concise guide to help you determine your home’s true market value.

1. Comparative Market Analysis (CMA)

One of the most common methods for estimating your home’s value is a Comparative Market Analysis (CMA). This involves comparing your property to similar homes (comps) that have recently sold in your area. To get a CMA, you can:

Consult a Real Estate Agent: Agents have access to MLS (Multiple Listing Service) data and can provide a detailed CMA report. They consider factors like size, condition, location, and recent sales.

Online Tools: Various online platforms offer automated valuation models (AVMs). While convenient, these tools may not always account for unique features or recent market changes.

2. Professional Appraisal

A professional appraisal provides an unbiased, expert opinion of your home’s value. Appraisers use a detailed methodology that includes:

Property Inspection: An appraiser will examine the interior and exterior of your home, noting features and condition.

Market Trends: They analyze recent sales of comparable properties and market conditions.

Replacement Cost: They estimate the cost to replace your home with a similar one, adjusting for depreciation.

An appraisal is a reliable method but typically costs between $300 and $500.

3. Evaluate Recent Sales

To gauge market trends, look at recent sales data for properties similar to yours. Focus on:

Sold Listings: Properties that have recently sold are the best indicators of current market conditions.

Active Listings: Homes currently on the market can give insights into pricing trends and competition.

Expired Listings: Properties that failed to sell can highlight potential pricing issues or market shifts.

4. Consider Market Conditions

Market conditions greatly influence property value. Factors to consider include:

Supply and Demand: In a seller’s market with high demand and low inventory, prices tend to rise. Conversely, a buyer’s market with high inventory and low demand can drive prices down.

Economic Indicators: Interest rates, employment rates, and economic growth can impact buyer affordability and market activity.

5. Assess Home Features

Unique features of your home can significantly affect its value:

Upgrades and Renovations: Recent renovations or higher upgrades (like a new kitchen or bathroom) can increase your home’s value.

Condition and Maintenance: A well-maintained home with no major issues typically commands a higher price.

Location: Factors such as proximity to schools, amenities, and neighborhood desirability can influence value.

6. Utilize Online Valuation Tools

Online valuation tools can provide a quick estimate of your home’s value. While these tools use algorithms and data to generate an estimate, they should be used as a starting point rather than a definitive value.

Conclusion

Determining your home’s true market value involves a combination of methods and considerations. Start with a Comparative Market Analysis or professional appraisal, evaluate recent sales, and consider current market conditions. Additionally, assess the unique features of your home and use online tools for a broader perspective. By combining these approaches, you can arrive at a well-rounded estimate of your home’s market value, helping you make informed decisions whether buying, selling, or refinancing.

Contact us for more information:-

Phone:- +91 7835005003

Email:- [email'protected]

Website:- https://property.sale